The CARES Act and End-of-Year Tax Implications

CARES Act for Nonprofits – Friday, March 27, Congress passed and the President signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion economic stimulus package legislated to provide immediate relief for nonprofits like the Children’s Safety Center. All donations must be made by midnight on December 31, 2020.

New Charitable Deduction Limits

- Individuals who itemize can deduct cash contributions up to 100% of their 2020 Adjusted Gross Income (AGI). Check and credit card payments are included. This is an increase from the previous 60% limit.

- Corporations may deduct up to 25% of their taxable income for cash contributions to 501(c)3 public nonprofits, including the Children’s Safety Center. This is an increase from the previous 10% limit.

- Taxpayers may donate more than 100% of AGI in 2020. Cash contributions above 100% may be carried forward five years, but the 60% annual limitation will return on January 1, 2021, unless extended COVID-19 relief is granted.

New Deduction Available

- A deduction is available for up to $300 per person even if individuals do not itemize their deductions for 2020 charitable contributions and take the standard deduction; it is $600 per married couple. This above-the-line adjustment reduces the AGI and, therefore, the amount of taxable income.

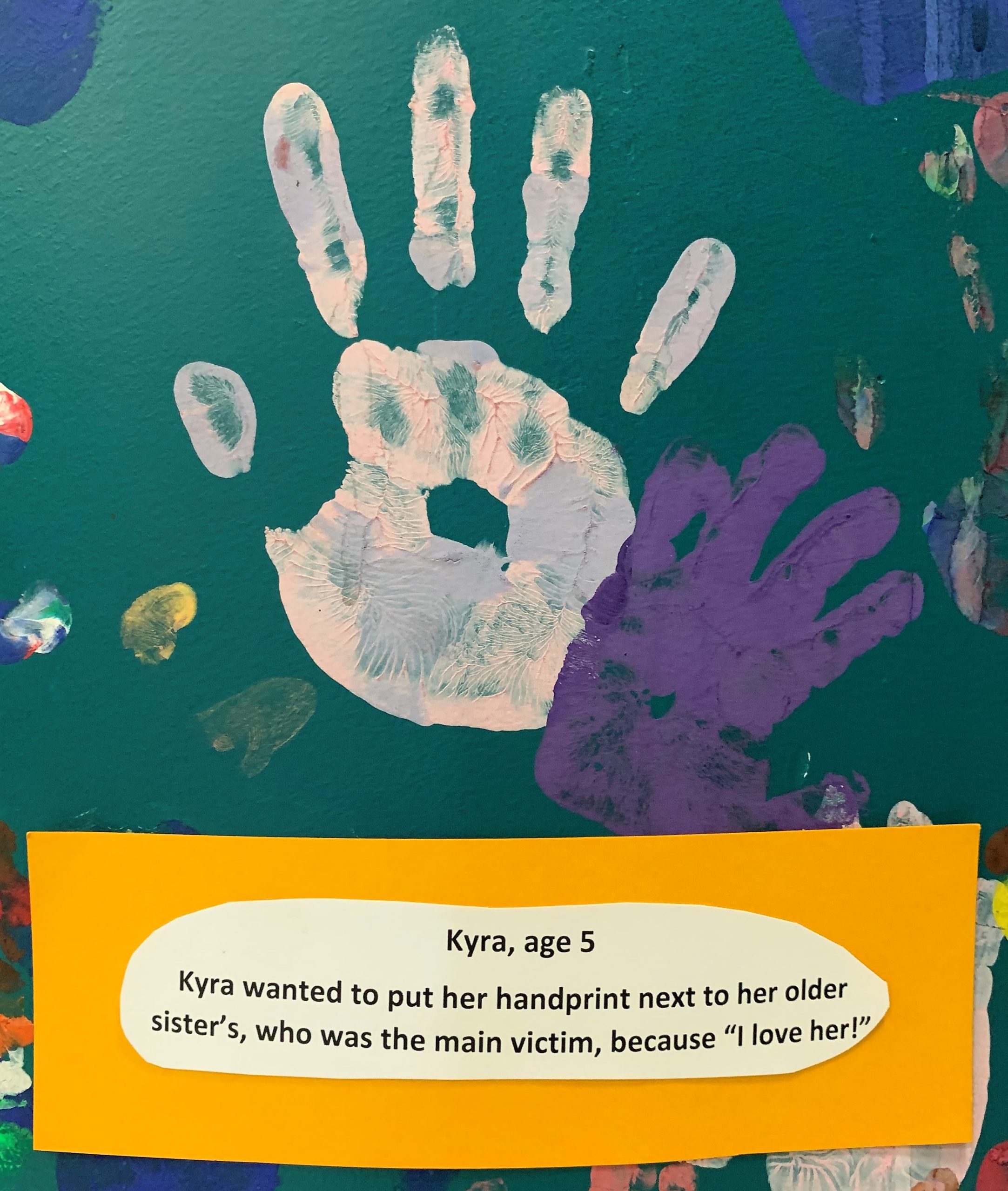

The Children’s Safety Center has continued to provide essential services to local child abuse victims and their families during the pandemic. Unfortunately, child abuse does not stop and neither have we. Our doors have never shut as we continue to provide free, critical services for our children and families.

630 – children have received initial services so far this year

1,184 – TeleHealth therapy sessions have been conducted

138 – COVID care packages have been provided to children and families (includes basic needs, groceries, school supplies, clothing, etc.)

1,410 – community members have been trained in child sexual abuse prevention, mandated reporting, and EmpowerME!

224 – children will have a very Merry Christmas through our Christmas for Kids program

YOU make it possible for victims of child abuse to have a safe place to tell their story and start to heal. The Hearts of our community are the Healers of our Handprints. We are so thankful for YOU!

|

The Children’s Safety Center is a 501(c)3 nonprofit. All of our services are provided free to our children and families. You can make an online donation HERE or make a check out to the Children’s Safety Center and mail to:

Children’s Safety Center

614 E. Emma Ave., Suite 200

Springdale, AR 72764

All donation and facility tour questions directed to development director

Emily Rappe’ Fisher, emily@childrenssafetycenter.org or call 479-872-6183

|

|