- Individuals who itemize can deduct cash contributions up to 100% of their 2020 Adjusted Gross Income (AGI). Check and credit card payments are included. This is an increase from the previous 60% limit.

- Corporations may deduct up to 25% of their taxable income for cash contributions to 501(c)3 public nonprofits, including the Children’s Safety Center. This is an increase from the previous 10% limit.

- Taxpayers may donate more than 100% of AGI in 2020. Cash contributions above 100% may be carried forward five years, but the 60% annual limitation will return on January 1, 2021, unless extended COVID-19 relief is granted.

- A deduction is available for up to $300 per person even if individuals do not itemize their deductions for 2020 charitable contributions and take the standard deduction; it is $600 per married couple. This above-the-line adjustment reduces the AGI and, therefore, the amount of taxable income.

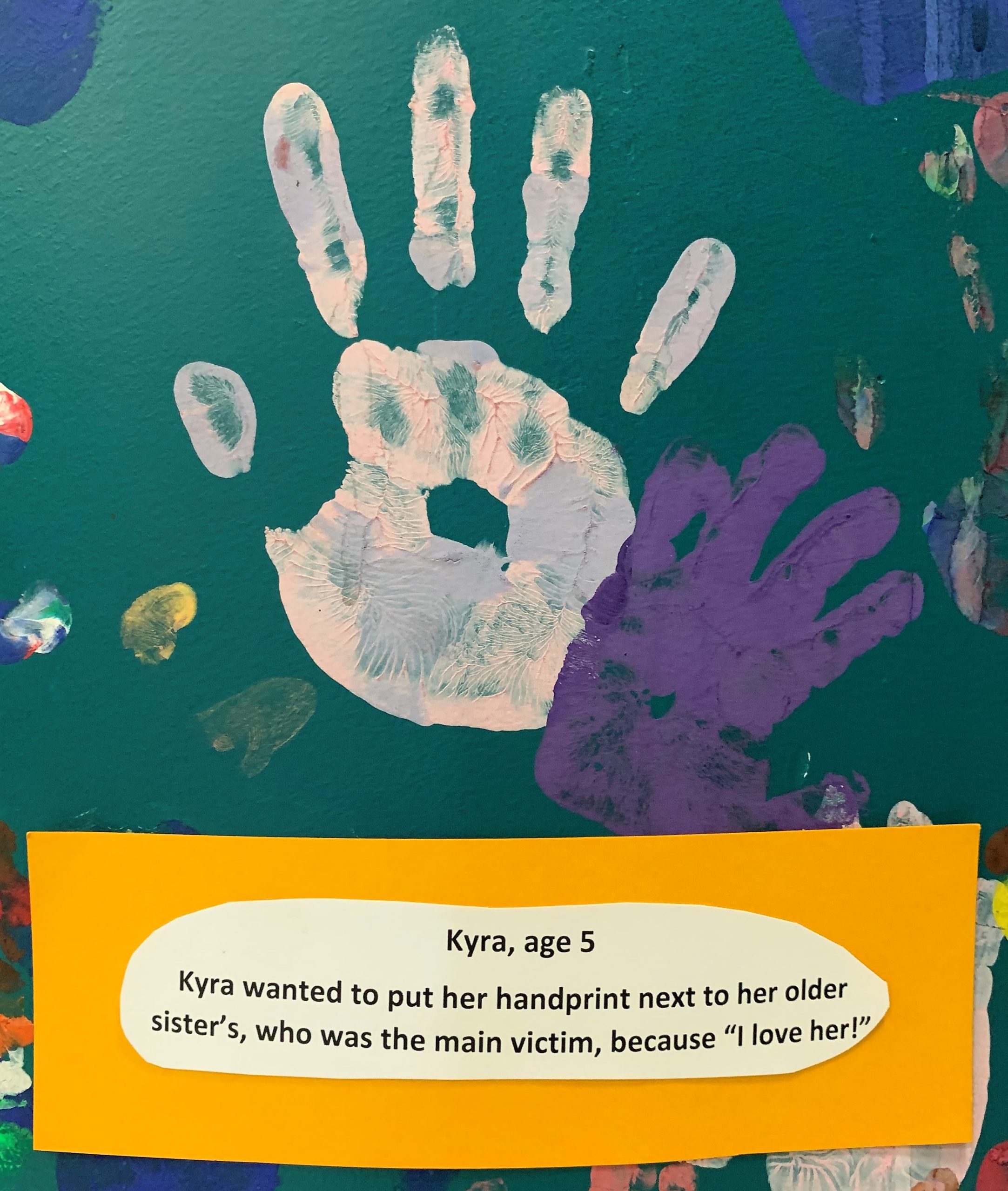

YOU make it possible for victims of child abuse to have a safe place to tell their story and start to heal. The Hearts of our community are the Healers of our Handprints. We are so thankful for YOU!

|

The Children’s Safety Center is a 501(c)3 nonprofit. All of our services are provided free to our children and families. You can make an online donation HERE or make a check out to the Children’s Safety Center and mail to:

Children’s Safety Center

614 E. Emma Ave., Suite 200

Springdale, AR 72764

All donation and facility tour questions directed to development director

Emily Rappe’ Fisher, emily@childrenssafetycenter.org or call 479-872-6183

|

|